Fix and Flip

Fast & Flexible. Built for Your Next Investment.

Flipping is a fast-paced industry, and success requires a lender who understands market shifts and supports your goals. At Turning Point Lending, we provide the flexibility and reliability you need to stay ahead and succeed.

Competitive Rates

Boost your profits with our competitive rates and tailored Fix and Flip loan terms.

Quick Closing

Close in as little as 7 business days and stay competitive with cash buyers.

High Leverage

Keep your capital intact with financing of up to 95% LTC on our Fix and Flip Loans.

Funding Your Next Flip with Speed and Flexibility.

Our Fix and Flip Loans are structured for quick approvals and competitive rates, empowering you to act on opportunities when they arise. With flexible terms and a streamlined process, you can confidently navigate your next project from purchase to profit.

Fix and Flip Program Highlights

Loan Amount: $75,000 - $2,500,000

Up to 90% of the purchase price

Up to 100% of the rehab budget

Fast draw process, disburse funds within 2-4 days

Up to 18-month term available

1-4 Single-Family Homes, Condos, Townhomes

LLCs, LPs, and Corporations

The Edge You Need to Flip with Confidence

At Turning Point Lending, we understand that speed is the key to your success. In the fast-paced world of Fix and Flip investments, delays can cost you opportunities. That’s why our streamlined, hassle-free application process is designed to get you approved and funded quickly.

But speed doesn’t mean cutting corners. We carefully balance efficiency with responsibility, ensuring every loan is secure, reliable, and tailored to your needs. With years of experience as real estate investors, we know the challenges you face—and we’re here to help you overcome them.

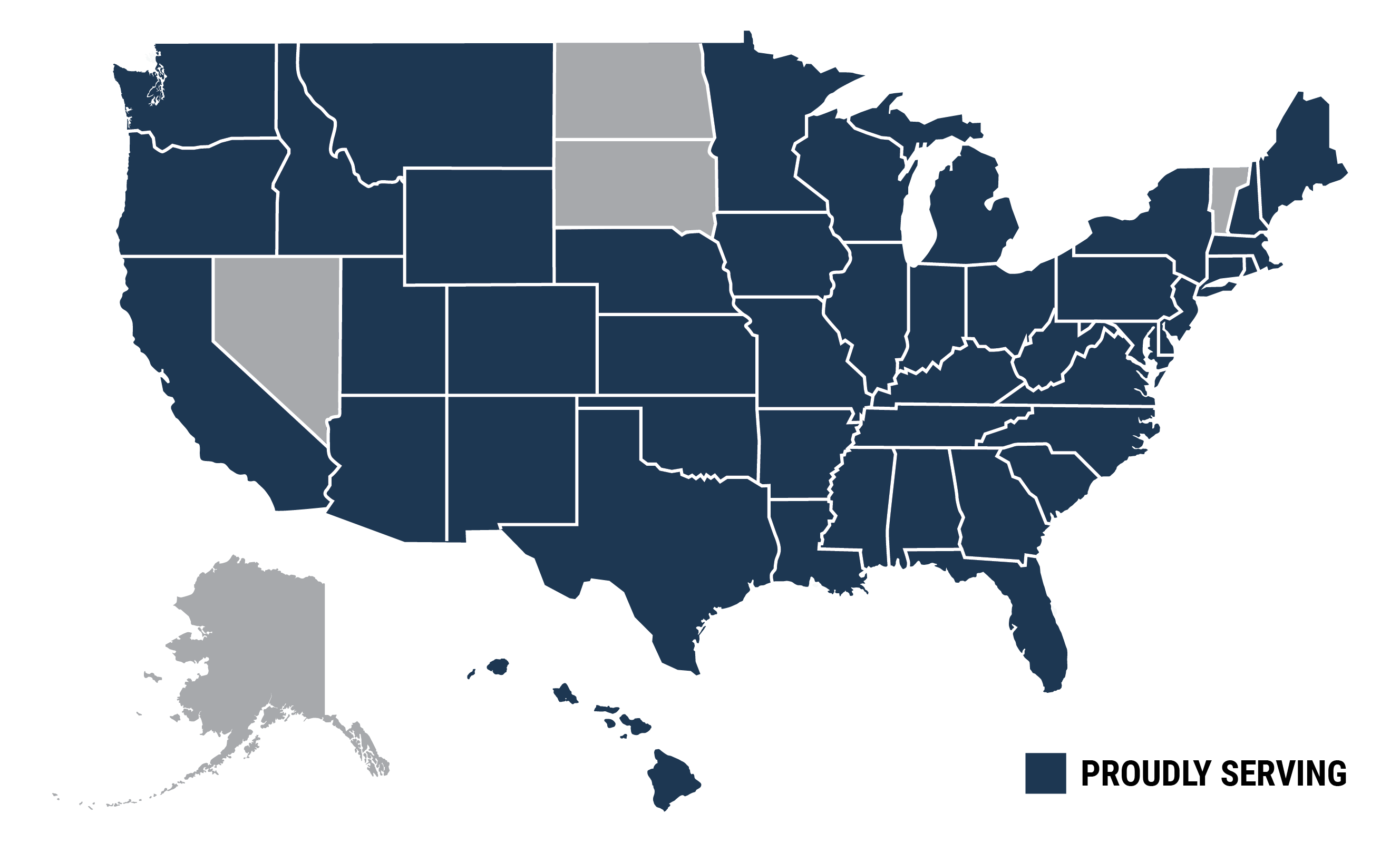

Trusted in 45 states, Turning Point Lending has built a reputation on proven results, strong partnerships, and the expertise to help investors succeed. We’re more than a lender—we’re your partner in growth, helping you secure the funding and confidence you need to thrive in today’s competitive market.

Fast, Reliable Draw Process to Keep Your Flip Moving

Access to capital at the right time is critical for a successful fix and flip project. Whether you’re updating a single-family home or tackling a larger renovation, delays in funding can slow progress and cut into your profits.

That’s why our main goal at Turning Point Lending is to make sure you get funds quickly and efficiently, with draws typically disbursed within 2 to 4 business days. Our process is designed for speed and simplicity, so you can focus on completing renovations and getting your property back on the market.

Fix and Flip FAQ

If you’re a fix and flip investor or looking to fix and hold properties, we would love to work with you. Our roots as house flippers drives us to be solid, trusted fix and flip lender.

Have questions about fix and flip loans? Whether you want to know how our lending process works or what it takes to get started, we’ve answered some of the most common questions real estate investors ask about fix and flip financing below.

What Is a Fix and Flip Loan and How Does It Work?

A fix and flip loan is a short-term real estate investment loan designed to help investors purchase, renovate, and sell properties for a profit. Unlike traditional mortgages, these loans are asset based and provide fast funding, allowing investors to cover the purchase price, renovation costs, and carrying expenses without long approval processes.

Most private lenders focus on the property’s value and the investor’s experience, rather than just credit scores. Fix and flip loans are commonly used by investors who follow the fix and flip model or the BRRRR strategy (Buy, Rehab, Rent, Refinance, Repeat) to build their rental portfolios.

At Turning Point Lending, we provide fast, flexible fix and flip financing designed to help investors scale their businesses efficiently. Our private money loans ensure you have the capital and speed needed to acquire, renovate, and sell properties without unnecessary delays.

What Are the Requirements for a Fix and Flip Loan?

The requirements for a fix and flip loan vary by lender, but private lenders typically focus on the property’s value, the investor’s experience, and deal profitability rather than just credit scores. Here are the most common criteria:

- Property Type – The loan must be used for non-owner-occupied residential properties intended for renovation and resale.

- Down Payment & Loan-to-Value (LTV) – Most lenders finance up to 90% of the purchase price and 100% of rehab costs, depending on the deal.

- Credit Score – While traditional lenders have strict credit score requirements, private lenders prioritize the deal’s profitability. A credit score of 650+ is typically preferred, but exceptions may be made.

- Experience Level – Having previous fix and flip experience is helpful but not always required. First-time investors can qualify with a strong deal and solid financials.

- Exit Strategy – Lenders want to see a clear plan for selling or refinancing the property within the loan term (usually 6 to 12 months).

- Reserves & Liquidity – Most lenders require cash reserves to cover loan payments, closing costs, and unexpected rehab expenses.

What Are the Costs of a Fix and Flip Loan?

The cost of a fix and flip loan depends on several factors, including the loan amount, interest rate, loan term, and lender fees. Unlike traditional mortgages, fix and flip loans are short-term, asset-based loans designed for speed and flexibility. Here’s a breakdown of typical costs:

- Interest Rates – Usually range from 10% to 13%, depending on the loan structure and borrower experience.

- Points (Origination Fees) – Typically 1 to 3 points (1% to 3% of the loan amount).

- Loan Term – Most fix and flip loans are 6 to 12 months, reducing long-term interest costs.

- Down Payment – Varies based on LTV (Loan-to-Value), but lenders often fund up to 90% of the purchase price and 100% of rehab costs.

- Other Fees – May include processing fees, appraisal fees, and closing costs.

At Turning Point Lending, we structure our fix and flip loans to keep costs low while maximizing your profit potential. Our competitive rates, fast approvals, and flexible terms ensure that your financing supports—not limits—your investment strategy.

Do I Need a Fix and Flip Loan If I Can Self-Fund My Project?

Even if you have the cash to self-fund your project, using a fix and flip loan can be a strategic advantage. The most successful real estate investors leverage financing to maximize their capital, scale faster, and reduce risk. Here’s why:

- Preserve Capital for More Deals – Instead of tying up all your cash in one project, financing allows you to spread your capital across multiple investments, increasing your earning potential.

- Maintain Strong Cash Flow – Unexpected rehab costs or market shifts can impact your budget. A loan ensures you have the financial flexibility to handle any situation.

- Small Cost, Big Returns – When used efficiently, a fix and flip loan is a small soft cost compared to the overall profitability of a well-managed flip.

At Turning Point Lending, we structure our loans to give you the speed, flexibility, and leverage needed to grow your real estate business efficiently.

How Does the Draw Process Work for a Fix and Flip Loan?

The draw process for a fix and flip loan ensures you receive funds in stages as your renovation progresses, rather than in a lump sum. This helps manage risk, control costs, and keep your project moving efficiently.

At Turning Point Lending, we’ve streamlined the draw process to make it fast and hassle-free:

- Request a Draw – As work is completed, you can submit a draw request to receive funds for the next phase of the project.

- Inspection & Approval – A quick property inspection confirms completed work, ensuring funds are released accordingly.

- Fast Disbursement – Once approved, draws are typically funded within 2 to 4 business days, keeping your project on track.

Our efficient draw system makes it easier to access capital when you need it, so you can focus on renovations and profitability without unnecessary delays.

What Are the Common Challenges in Fix and Flip Investing and How Do We Help?

Fix and flip investing can be very profitable, but not without challenges that can impact timelines, budgets, and profitability. We understand these obstacles and provide solutions to help investors navigate them successfully.

- Funding Delays – Traditional lenders can take weeks or months to approve financing, causing missed opportunities. Our fast approvals (24 to 48 hours) and closings (as little as 7 days) ensure you secure deals quickly.

- Rehab Cost Overruns – Unexpected repair costs can eat into profits. Our flexible loan structures help you stay financially prepared throughout your project.

- Market Fluctuations – A shifting market can affect sale prices and timelines. We offer short-term, asset-based loans that allow you to pivot quickly as needed.

- Exit Strategy Challenges – Whether selling or refinancing, knowing where you are going is crucial. Our fix and flip loans give you the financial flexibility to sell at the right time or transition into a rental strategy.

At Turning Point Lending, we go beyond just providing loans. We act as a trusted financial partner, helping you overcome obstacles, scale your business, and maximize returns.

Why Choose Turning Point Lending for Your Fix and Flip Loans?

At Turning Point Lending, we do more than just provide fix and flip loans. We partner with real estate investors to create tailored financing solutions that fit their unique needs. Our fast approvals, competitive rates, and flexible terms give you the capital and confidence to purchase, renovate, and sell properties for profit.

Unlike traditional lenders, we take a relationship-driven approach, offering the support and expertise needed to help you scale your investment business. With our streamlined loan process, reliable funding, and investor-friendly terms, you can focus on executing your strategy and maximizing returns.

TestimonialsWhy do our Borrowers love Turning Point Lending?

Our Service Area