Loan Programs

Your Strategy + Our Loans Programs =

Success Made Simple.

Every real estate investor has a unique path. Whether you focus on rehabbing properties, building a rental portfolio, or tackling new construction projects, our flexible loan options are designed to support your vision and drive your success. With a commitment to understanding your goals, we provide solutions tailored to help you achieve them with ease.

Fix & Flip

Designed for Flip or Hold investors seeking to build profit or equity through property renovations.

New Construction

Ideal for ground-up builds, this loan is tailored to meet the unique demands of your projects.

As-is Bridge

A short-term solution for properties needing no rehab, bridging purchase to permanent financing.

FIX & FLIP

Fast & Flexible. Built for Your Next Investment.

When it comes to fix-and-flip projects, having a trusted lending partner is the key to scaling your business and staying ahead of the competition. At Turning Point Lending, our Fix & Flip loan programs are tailored to help you maximize your leverage, lower your upfront costs, and keep your projects moving forward seamlessly.

Streamlined Financing for Ground-Up Projects.

New Construction

Breaking ground on a new construction project requires the right financial partner to turn your vision into reality. Turning Point Lending’s New Construction loan programs are designed to provide flexible funding, reduce upfront costs, and keep your project on track from start to finish. Whether you're building single-family homes or multi-unit developments, we're here to help you succeed.

Fast Solutions for Immediate Needs.

When timing is critical, and opportunities can’t wait, Turning Point Lending’s As-Is Bridge loan programs provide the short-term financing you need to secure your next investment. Designed for properties in their current condition, our bridge loans offer speed, flexibility, and competitive terms to help you close deals quickly and confidently. Whether you’re purchasing a property to renovate, reposition, or hold, we’re here to support your goals.

AS-IS BRIDGE

Smart Financing for Long-Term Growth.

DSCR RENTAL

Building your rental portfolio is about creating steady cash flow and long-term wealth. Turning Point Lending’s DSCR Rental loan programs are designed to streamline the financing process by focusing on the property’s income potential, not your personal income. With competitive rates, flexible terms, and a simple qualification process, our loans empower you to grow your portfolio with confidence and ease.

TestimonialsWhy do our Borrowers love Turning Point Lending?

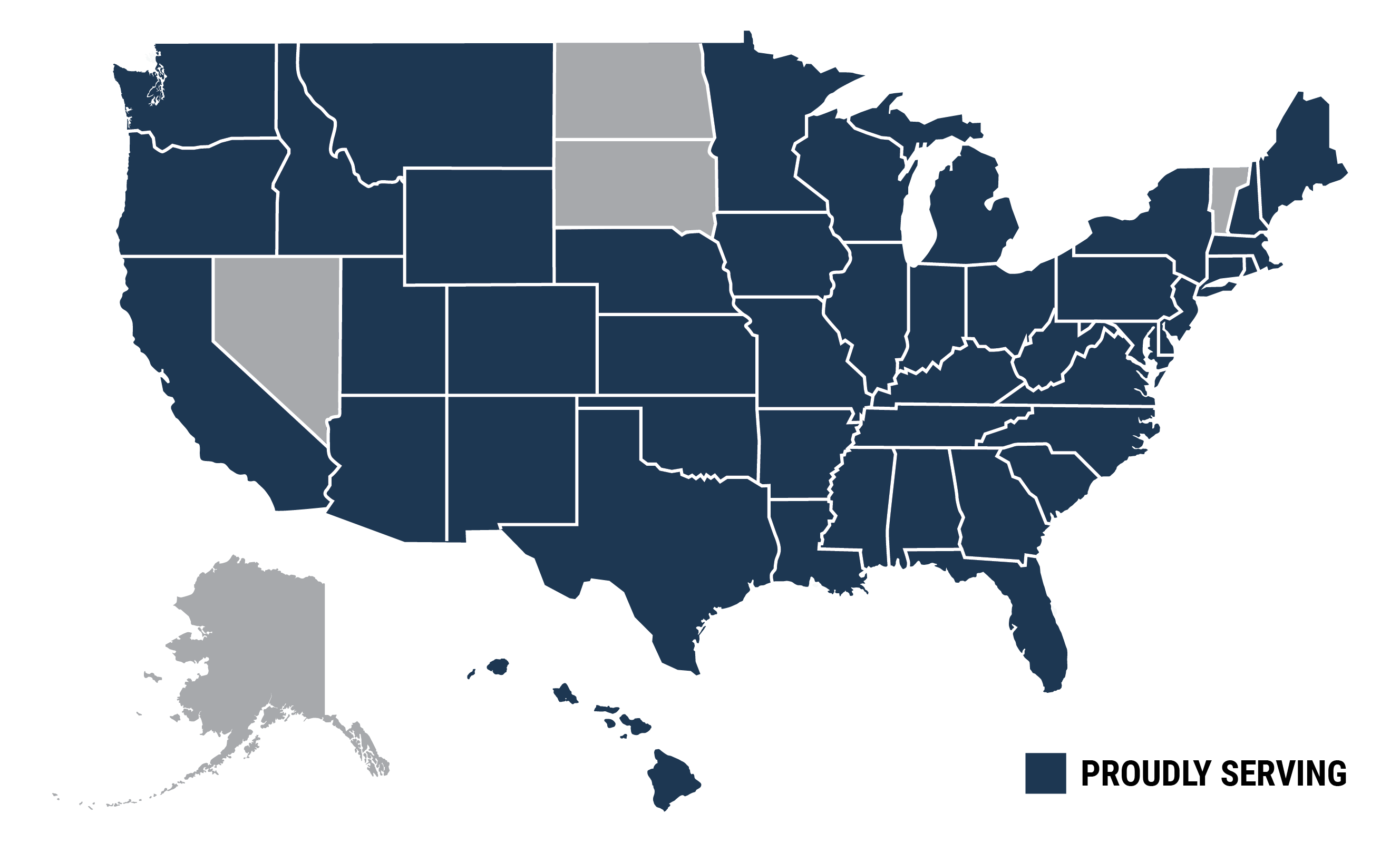

Our Service Area