As-is bridge

Fast Solution For Immediate Needs.

When timing is critical, Turning Point Lending's As-Is Bridge loans provide short-term financing for properties in their current condition. With speed and flexibility, we help you secure opportunities and bridge the gap with confidence.

Competitive Rates

Boost your profits with our competitive rates and tailored As-Is Bridge loan terms.

Quick Closing

Close in as little as 7 business days and stay competitive with cash buyers.

High Leverage

Keep your capital intact with financing of up to 80% LTV on our As-Is Bridge Loans.

Bridging the Gap with Fast, Flexible Financing.

Our As-Is Bridge Loans are designed to provide quick, flexible financing for properties in their current condition. Whether you're preparing for a long-term strategy or need time to transition from purchase to permanent financing, we’ve got you covered.

Bridge Program Highlights

Loan Amount: $75,000 - $2,500,000

Finance up to 75% LTV

Up to 18-month term available

1-4 Single-Family Homes, Condos, Townhomes

No pre-payment penalty

Cashout options available

LLCs, LPs, and Corporations

Flexible Funding for Every Opportunity

Our As Is Bridge Loans are the perfect solution for tenant occupied properties and beyond. We provide fast and flexible financing for investment properties that don’t require rehab but still need funding for various reasons. Whether you are acquiring a property, stabilizing rents, or increasing value, Turning Point Lending has you covered.

We structure our Bridge Loans with your specific goals at the core. Whether your exit strategy is to sell for a profit or hold the property as a rental, we can allow you to invest with confidence.

As-Is Bridge FAQ

At Turning Point Lending, we specialize in As-Is Bridge Loans designed to help investors close quickly, preserve liquidity, and execute their exit strategies with confidence. Below, we answer some of the most common questions about how these loans work and how they can support your investment strategy.

What Are As-Is Bridge Loans and How Do They Work?

An As Is Bridge Loan is a short-term financing solution designed for real estate investors who need quick funding for properties that do not require renovations. These loans are ideal for tenant occupied properties, acquisitions, and value-add opportunities where investors plan to hold, refinance, or resell.

Unlike traditional mortgages, As-Is Bridge Loans are asset based, meaning approval is focused on the property’s value and the investor’s exit strategy rather than just credit scores. These loans provide fast approvals and flexible terms, allowing investors to close quickly and execute their investment strategy without delays.

What Are the Requirements for an As Is Bridge Loan?

The requirements for an As Is Bridge Loan vary by lender, but private lenders typically focus on the property’s value, investor experience, and exit strategy rather than just credit scores. Here are the most common criteria:

- Property Type – Must be a non-owner-occupied residential investment property.

- Loan to Value (LTV) – Most lenders finance up to 75% of the property’s value.

- Credit Score – While credit is considered, private lenders prioritize deal profitability over credit score. A 650+ score is typically preferred, but exceptions may be made.

- Exit Strategy – Investors should have a clear plan to sell, refinance, or lease the property within the loan term (typically 6 to 18 months).

- Reserves & Liquidity – Some lenders require cash reserves to cover loan payments and closing costs.

What Are the Costs of an As Is Bridge Loan?

The cost of a fix and flip loan depends on several factors, including the loan amount, interest rate, loan term, and lender fees. Unlike traditional mortgages, fix and flip loans are short-term, asset-based loans designed for speed and flexibility. Here’s a breakdown of typical costs:

- Interest Rates – Usually range from 10% to 13%, depending on the loan structure and borrower experience.

- Points (Origination Fees) – Typically 1 to 3 points (1% to 3% of the loan amount).

- Loan Term – Most fix and flip loans are 6 to 12 months, reducing long-term interest costs.

- Down Payment – Varies based on LTV (Loan-to-Value), but lenders often fund up to 90% of the purchase price and 100% of rehab costs.

- Other Fees – May include processing fees, appraisal fees, and closing costs.

At Turning Point Lending, we structure our fix and flip loans to keep costs low while maximizing your profit potential. Our competitive rates, fast approvals, and flexible terms ensure that your financing supports—not limits—your investment strategy.

How Fast Can I Get Approved and Funded for an As-Is Bridge Loan?

Traditional lenders may take months to approve financing, but private lenders offer a much faster process designed for real estate investors who need quick access to capital. Turning Point Lending prioritizes speed and efficiency to keep your investments moving forward:

- Pre Approvals – Borrowers can receive pre-approval within 24 to 48 hours after submitting a loan application.

- Loan Closings – Once approved, loans can close in as little as 7 to 14 days, depending on deal complexity.

What Types of Properties Are Eligible for an As-Is Bridge Loan?

The short answer: non-owner-occupied investment properties that do not require rehab.

Examples:

- Tenant-Occupied Properties – Financing for properties already generating rental income.

- Stabilizing Investments – Gives investors time to adjust rental rates or occupancy before refinancing.

- Short-Term Holds – Helps bridge the gap between acquisitions and permanent financing.

- Portfolios & Multi-Property Acquisitions – Allows investors to secure multiple properties quickly without long-term debt.

Can I Use an As-Is Bridge Loan for a Tenant-Occupied Property?

Yes! As-Is Bridge Loans are an excellent solution for tenant-occupied properties, whether you are acquiring, refinancing, or stabilizing an asset. These loans allow investors to secure short-term financing without requiring property improvements.

Why Choose Turning Point Lending for Your As-Is Bridge Loan?

We partner with real estate investors to offer fast, flexible, and strategic financing solutions designed to help you close deals with confidence. With Turning Point Lending, you get more than just a loan. You get a financing partner committed to helping you scale your business, maximize your profits, and help you grow with confidence.

TestimonialsWhy do our Borrowers love Turning Point Lending?

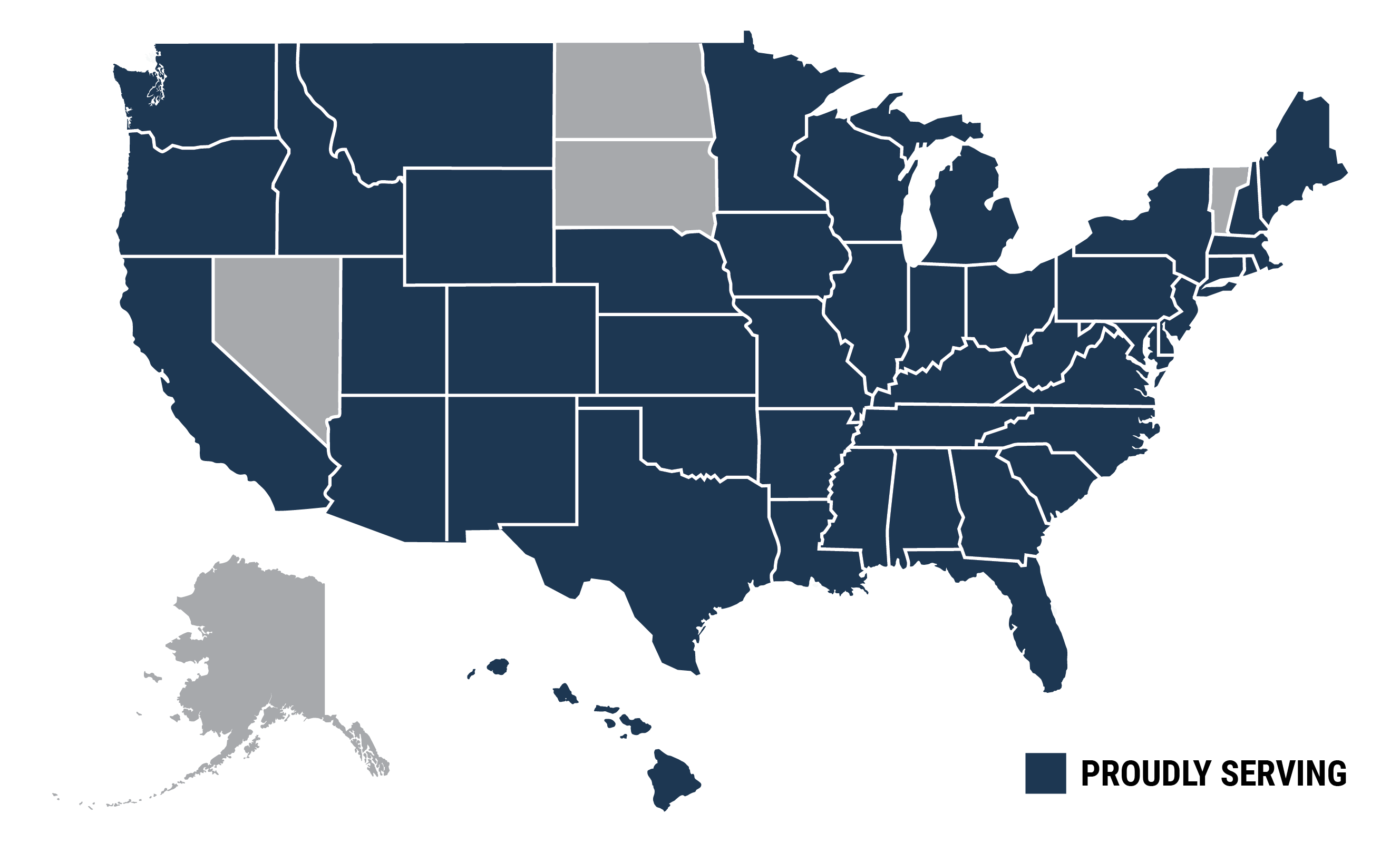

Our Service Area