DSCR RENTAL

Long-Term Financing for Rental Properties.

At Turning Point Lending, our DSCR Rental loans provide permanent financing for rental properties. With flexible terms tailored to your strategy, we make it easy to grow and sustain your portfolio.

Competitive Rates

Boost your profits with our competitive rates and tailored DSCR Rental loan terms.

High Leverage

Keep your capital intact with financing of up to 80% LTV on our DSCR Rental Loans.

Flexibility & Support

Diverse loan options and expert support help maximize your ROI and streamline the process.

Flexible Financing Built for Your Rental Investments.

Our DSCR Rental loans provide the flexibility needed to grow and sustain your portfolio. Whether you’re purchasing new properties, refinancing existing ones, or expanding into short-term rentals, this program offers competitive terms and options tailored to your strategy.

Rental DSCR Program Highlights

Loan Amount: $150,000 to $3,000,000

Up to 80% LTV on purchase & 75% LTV on cash-out

30-year fixed rates

Interest-only options

Single Family, Portfolio, and Short-Term Rental options available

No pre-payment penalty options available

No personal income requirements

Financing Designed for Your Rental Portfolio

Our DSCR Rental Loans are ideal for investors using the BRRRR method (Buy, Rehab, Rent, Refinance, Repeat) or looking to acquire new properties, refinance existing ones, or expand into short-term rentals. We structure our loans to align with your investment strategy and help you maximize your cash flow and earning potential.

With a focus on efficiency and transparency, our streamlined process ensures a smooth transition from application to funding. Turning Point Lending strives to provide the reliable financing and expert support you need to thrive in today’s rental market.

Refinance & Repeat: Unlocking the Full Potential of BRRRR

Our DSCR Rental Loans are designed to support real estate investors using the BRRRR strategy (Buy, Rehab, Rent, Refinance, Repeat) by providing seamless transition financing from short-term to long-term rental loans.

Start by acquiring the property with a Fix and Flip or Bridge Loan, which covers both the purchase and renovation costs. Once the rehab is complete and the property is stabilized with tenants, you can refinance into a long-term DSCR Rental Loan at a competitive rate. This allows you to pull out equity through cash-out refinancing, giving you the capital to reinvest into your next BRRRR property while keeping your rental portfolio growing.

DSCR Rental FAQ

Financing rental properties shouldn’t be complicated. DSCR Rental Loans provide a simplified, long-term financing solution for real estate investors by focusing on a property’s income potential rather than personal income verification. Below, we answer some of the most common questions about how these loans work and how they can benefit your rental investment strategy.

What Is a DSCR Rental Loan and How Does It Work?

A DSCR (Debt Service Coverage Ratio) Rental Loan is a long-term financing solution designed for real estate investors who want to acquire or refinance rental properties. Instead of evaluating the borrower’s personal income, lenders assess the property’s ability to generate sufficient rental income to cover debt payments and property expenses—this is known as the Debt Service Coverage Ratio (DSCR).

The DSCR formula is simple. DSCR = Rental Income ÷ (Mortgage Payment + Property Taxes + Insurance + HOA Fees, if applicable). In short, a DSCR of 1.0 means the property breaks even. Above 1.0 means positive cash flow while below means no positive cash flow. In that latter instance, additional reserves, a lower loan amount, or a higher down payment would be necessary to make things work.

What Are the Requirements for a DSCR Rental Loan?

The requirements for a DSCR Rental Loan vary by lender, but private lenders focus on the property’s income potential and debt service coverage ratio (DSCR) rather than personal income. Here are the most common criteria:

- Property Type – Must be a non-owner-occupied residential investment property, including single-family homes, condos, townhomes, or multi-unit properties.

- Debt Service Coverage Ratio (DSCR) – Most lenders require a minimum DSCR of 1.0 to 1.25, meaning the property must generate enough rental income to cover mortgage payments, taxes, insurance, and HOA fees (if applicable).

- Loan-to-Value (LTV) – Lenders typically finance up to 80% of the property’s value for purchases and up to 75% for refinances.

- Credit Score – A minimum credit score of 640 to 680 is preferred, but requirements vary based on LTV and DSCR strength.

- Reserves & Liquidity – Some lenders require cash reserves to cover several months of mortgage payments.

Turning Point Lending’s flexible, investor-friendly DSCR Rental Loans are designed to help you secure long-term financing and grow your rental portfolio with ease.

What Are the Costs of a DSCR Rental Loan?

The cost of a DSCR Rental Loan depends on several factors, including loan amount, interest rate, loan term, and lender fees.

Here’s a breakdown of typical costs:

- Interest Rates – Typically range from 7% to 10%, depending on loan structure, DSCR ratio, LTV, and borrower credit profile.

- Points (Origination Fees) – Usually 1 to 3 points (1% to 3% of the loan amount).

- Loan Term – Most DSCR Rental Loans offer fixed-rate term of 30 years.

- Loan-to-Value (LTV) – Lenders typically finance up to 80% for purchases and up to 75% for refinances.

- Other Fees – May include processing fees, appraisal fees, and closing costs.

How Fast Can I Get Approved and Funded for a DSCR Rental Loan?

Speed is essential when securing a DSCR Rental Loan, especially in competitive real estate markets. While traditional lenders may take more than a month to approve financing, private lenders offer a faster and more efficient process designed specifically for real estate investors.

- Pre-Approvals – Borrowers can receive pre-approval within 24 to 48 hours after submitting a loan application.

- Loan Closings – Once approved, loans can close in as little as 14 to 21 days, depending on deal complexity.

Our streamlined underwriting and investor-focused process allow you to secure long-term financing quickly, so you can focus on scaling your rental portfolio without delays.

Can I Use a DSCR Loan for Short-Term Rentals Like Airbnb?

Yes, DSCR Rental Loans can be used to finance short-term rental properties, including those listed on Airbnb, Vrbo, and other vacation rental platforms.

- Eligible Properties – Single-family homes, condos, townhomes, and multi-unit properties that comply with local short-term rental regulations.

- Rental Income Consideration – Some lenders may use actual short-term rental income based on market performance, while others use long-term rental projections.

- Loan Terms – Typically 30-year fixed-rate, with up to 80% LTV for purchases and 75% LTV for refinances.

At Turning Point Lending, we offer DSCR Rental Loans designed to help investors finance, expand, and scale their short-term rental portfolios with ease.

Can I Refinance an Existing Rental Property with a DSCR Loan?

Yes, DSCR Rental Loans are a great way to refinance existing rental properties, whether you’re looking to lower your interest rate, extend your loan term, or pull cash out for future investments.

There are two options for this scenario, Rate & Term Refinance or a Cash-Out Refinance. A Rate & Term Refinance allows investors to replace their existing loan with a new DSCR loan, often with better terms and a fixed-rate structure. A Cash-Out Refinance means investors can access built-up equity in the form of capital for new acquisitions, property improvements, or portfolio expansion.

What Are the Common Challenges in Fix and Flip Investing and How Do We Help?

Yes, DSCR Rental Loans are a great way to refinance existing rental properties, whether you’re looking to lower your interest rate, extend your loan term, or pull cash out for future investments.

There are two options for this scenario, Rate & Term Refinance or a Cash-Out Refinance. A Rate & Term Refinance allows investors to replace their existing loan with a new DSCR loan, often with better terms and a fixed-rate structure. A Cash-Out Refinance means investors can access built-up equity in the form of capital for new acquisitions, property improvements, or portfolio expansion.

Q: Why Choose Turning Point Lending for Your DSCR Rental Loan?

We provide DSCR Rental Loans designed specifically for real estate investors looking to scale their rental portfolios without personal income verification. Our streamlined process, competitive rates, and flexible loan terms make securing long-term financing simple and efficient.

- Fast Pre Approvals & Closings – Get pre-approved within 24 to 48 hours and close in as little as 14 to 21 days.

- Flexible Loan Structures – Financing options for long-term rentals, short-term vacation rentals, and multi-property portfolios.

- No Personal Income Requirements – Loan approval is based on rental income and property cash flow, not tax returns or W-2s.

- Industry Expertise – As real estate investors ourselves, we understand the challenges of rental property financing and structure loans to help you maximize cash flow and long-term wealth.

Why Choose Turning Point Lending for Your DSCR Rental Loan?

We provide DSCR Rental Loans designed specifically for real estate investors looking to scale their rental portfolios without personal income verification. Our streamlined process, competitive rates, and flexible loan terms make securing long-term financing simple and efficient.

- Fast Pre Approvals & Closings – Get pre-approved within 24 to 48 hours and close in as little as 14 to 21 days.

- Flexible Loan Structures – Financing options for long-term rentals, short-term vacation rentals, and multi-property portfolios.

- No Personal Income Requirements – Loan approval is based on rental income and property cash flow, not tax returns or W-2s.

- Industry Expertise – As real estate investors ourselves, we understand the challenges of rental property financing and structure loans to help you maximize cash flow and long-term wealth.

TestimonialsWhy do our Borrowers love Turning Point Lending?

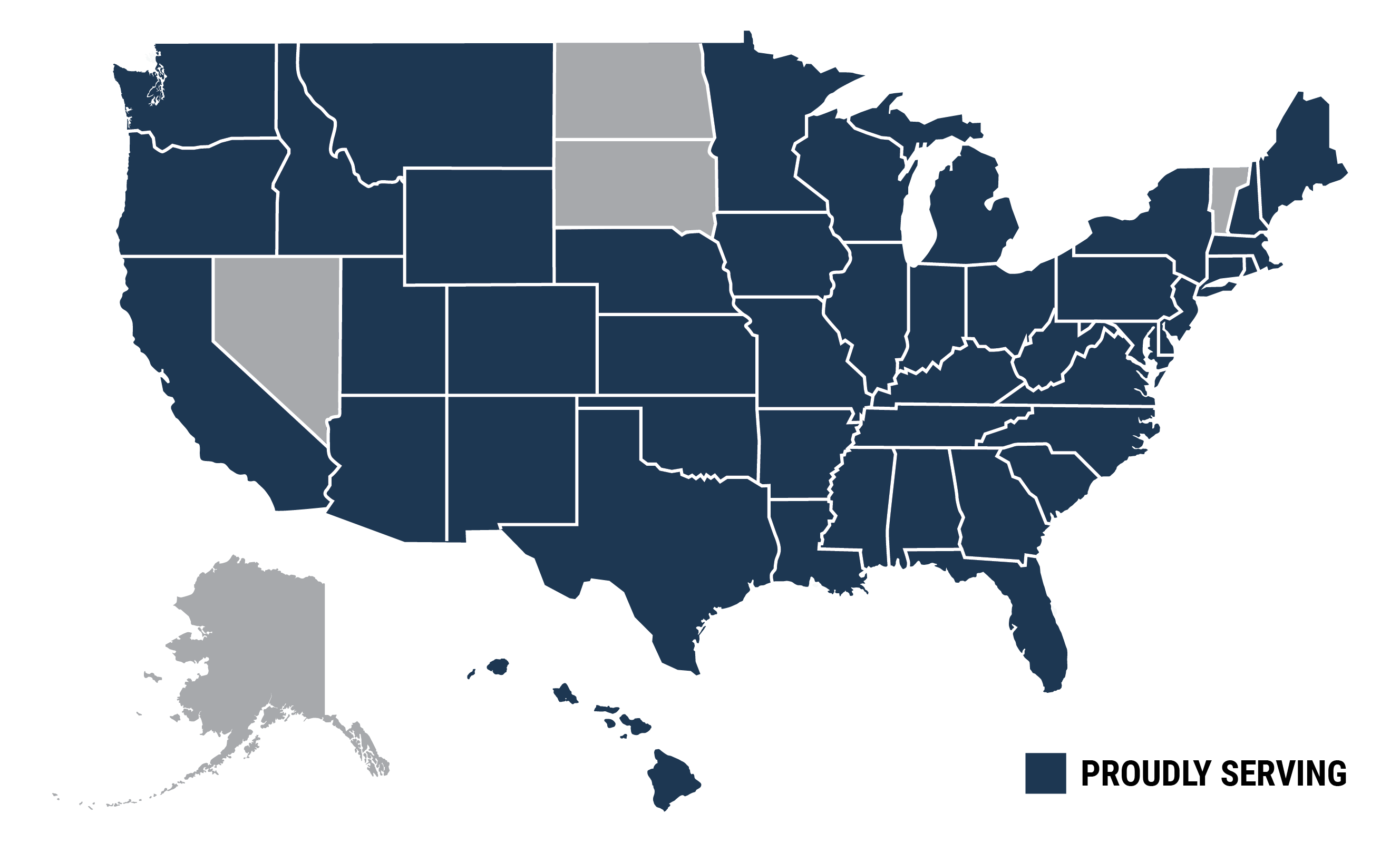

Our Service Area