Loan Programs

Your Strategy + Our Loans Programs =

Success Made Simple.

Every real estate investor has a unique path. Whether you focus on rehabbing properties, building a rental portfolio, or tackling new construction projects, our flexible loan options are designed to support your vision and drive your success. We work along side you to ensure your goals become a reality.

01

FIX & FLIP

This loan product is designed for both Flip and Hold Investors looking to create profit or equity through rehab.

02

NEW CONSTRUCTION

If your niche is ground-up builds, this loan product can be structured to support your specific needs.

03

AS-IS BRIDGE

Properties that do not require rehab, but only time to transition from purchase to permanent financing.

04

DSCR RENTAL

A permanent financing solution for all of your rental portfolio properties complete with numerous term options.

FIX & FLIP

Fast & Flexible. Built for Your Next Investment.

When it comes to fix-and-flip projects, having a trusted lending partner is the key to scaling your business and staying ahead of the competition. At Turning Point Lending, our Fix & Flip loan programs are tailored to help you maximize your leverage, lower your upfront costs, and keep your projects moving forward seamlessly.

NEW CONSTRUCTION - GROUND UP

Streamlined Financing for Ground-Up Projects.

Breaking ground on a new construction project requires the right financial partner to turn your vision into reality. Turning Point Lending’s New Construction loan programs are designed to provide flexible funding, reduce upfront costs, and keep your project on track from start to finish. Whether you're building single-family homes or multi-unit developments, we're here to help you succeed.

AS-IS BRIDGE

Fast Solutions for Immediate Needs.

When timing is critical, and opportunities can’t wait, Turning Point Lending’s As-Is Bridge loan programs provide the short-term financing you need to secure your next investment. Designed for properties in their current condition, our bridge loans offer speed, flexibility, and competitive terms to help you close deals quickly and confidently. Whether you’re purchasing a property to renovate, reposition, or hold, we’re here to support your goals.

DSCR RENTAL

Smart Financing for Long-Term Growth.

Smart Financing for Long-Term Growth. Building your rental portfolio is about creating steady cash flow and long-term wealth. Turning Point Lending’s DSCR Rental loan programs are designed to streamline the financing process by focusing on the property’s income potential, not your personal income. With competitive rates, flexible terms, and a simple qualification process, our loans empower you to grow your portfolio with confidence and ease.

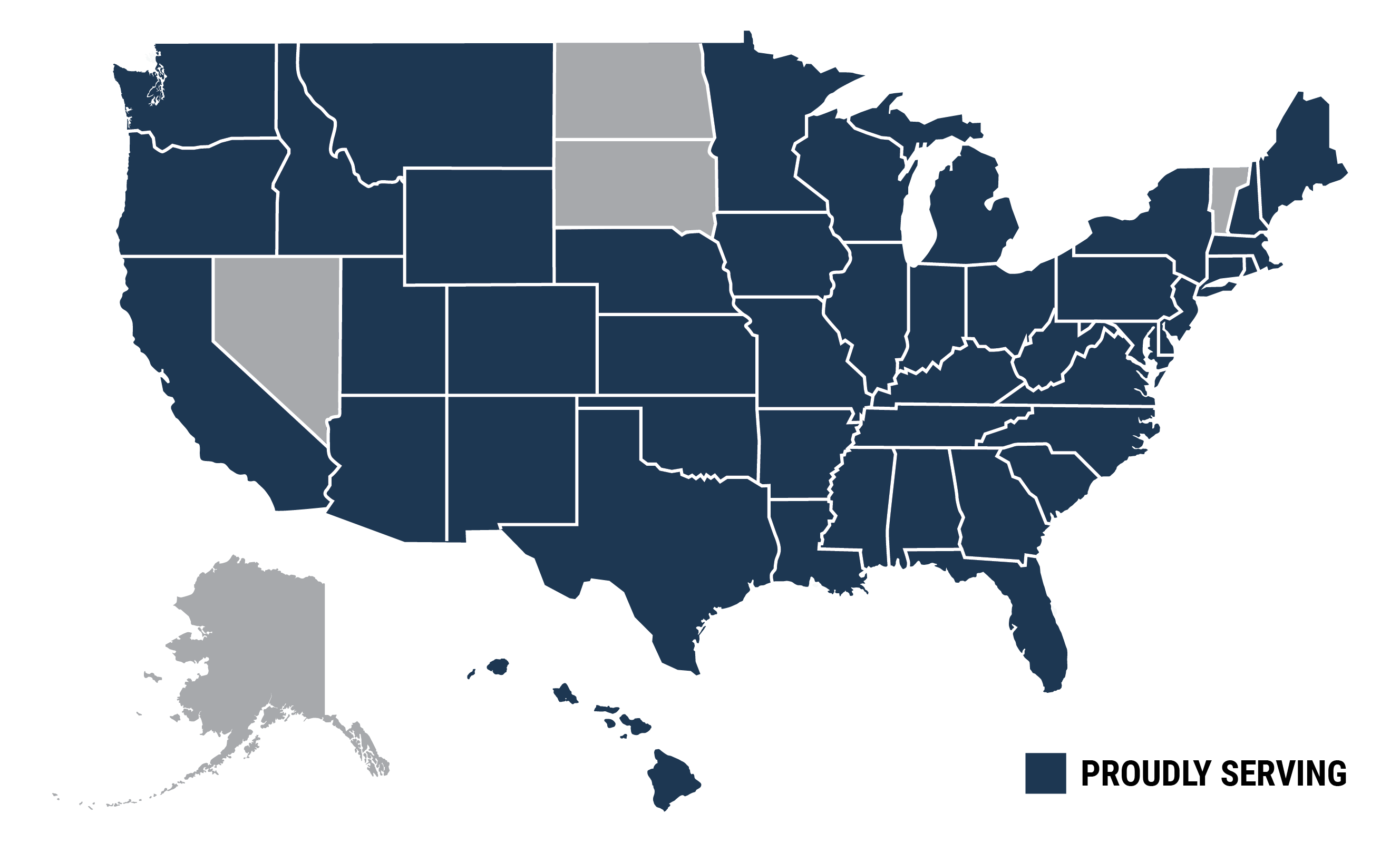

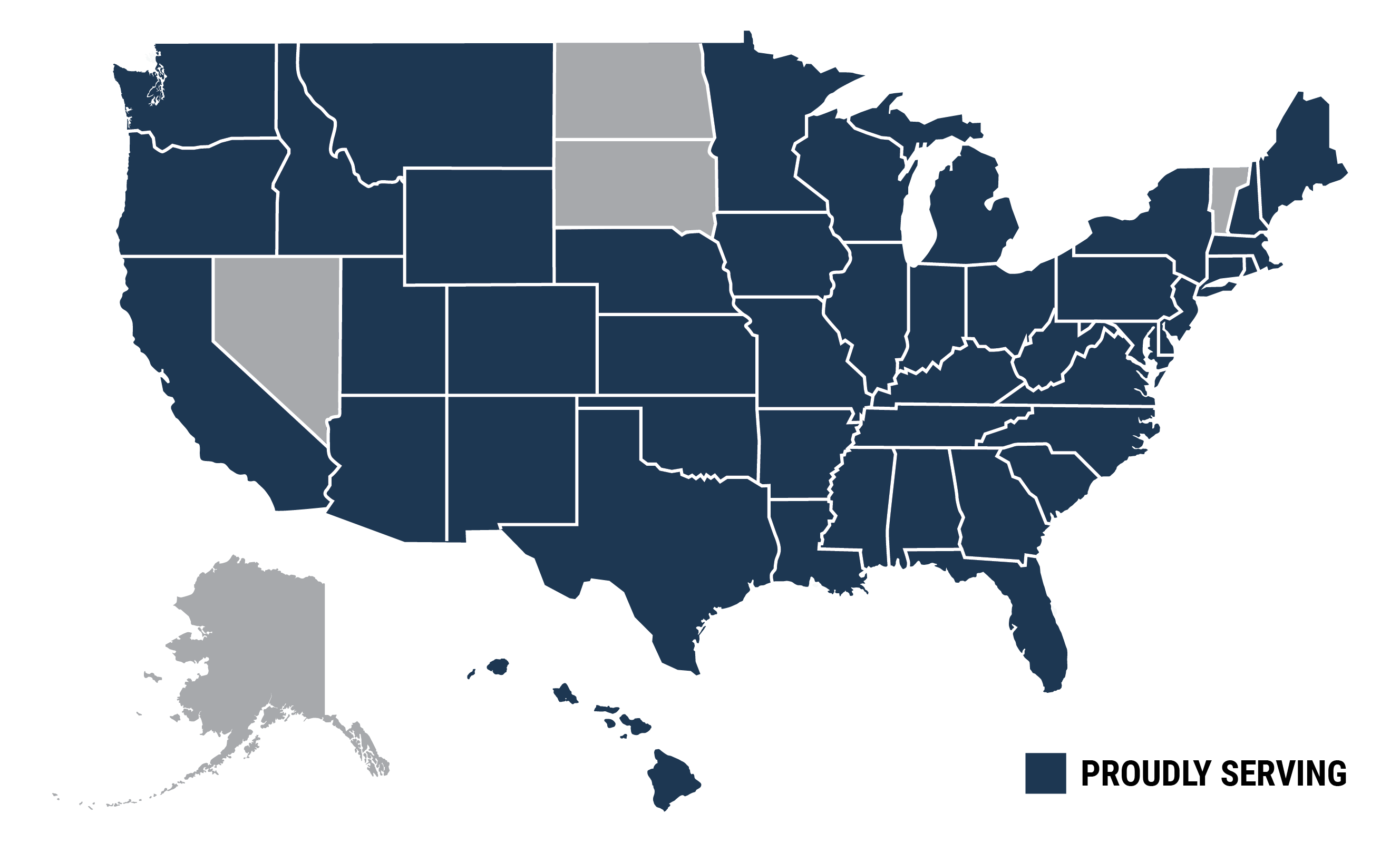

Our Service Area

Testimonials

"Turning Point Lending provided excellent service and quick funding for my fix and flip project in Alabama. They understood my needs and delivered beyond expectations."

John DMontgomery, AL

"In Arizona, I was impressed by the professionalism and speed at which Turning Point Lending operates. They made my rehab project seamless."

Lisa MPhoenix, AZ

"As a first-time real estate investor in Arkansas, I appreciated the guidance and support from Turning Point Lending. Their expertise made all the difference."

Mark RLittle Rock, AR

"Turning Point Lending's team is incredibly knowledgeable and efficient. They helped me secure funding quickly for my California renovation project."

Sarah TSacramento, CA

"Their loan process in Colorado is straightforward and hassle-free. Turning Point Lending provided the funds I needed to complete my fix and flip in record time."

David HDenver, CO

"I highly recommend Turning Point Lending for their exceptional customer service and quick turnaround times in Connecticut. They are a true partner in real estate investment."

Emily GHartford, CT

"Turning Point Lending exceeded my expectations with their flexible loan options and prompt funding for my Delaware project. My project was a success thanks to their support."

Michael BDover, DE

"The team at Turning Point Lending is professional, responsive, and knowledgeable. They made the lending process smooth and efficient for my Florida fix and flip."

Jessica STampa, FL

"I am thrilled with the service I received from Turning Point Lending for my Georgia rehab. Their quick funding and competitive rates are unmatched."

Brian LAtlanta, GA

"Turning Point Lending's expertise in hard money loans made my fix and flip project in Hawaii a breeze. Their team is top-notch."

Rebecca PHonolulu, HI

"From start to finish, Turning Point Lending provided exceptional service. Their quick funding allowed me to complete my Idaho project ahead of schedule."

James KBoise, ID

"I couldn't have asked for a better lending partner for my Illinois project. Turning Point Lending's professional approach and quick disbursals were crucial to my success."

Amanda FChicago, IL

Turning Point Lending made the entire process easy and stress-free for my Indiana fix and flip. Their team's knowledge and support were invaluable."

Richard WIndianapolis, IN

"Their quick and efficient loan process helped me stay on track with my project timeline in Iowa. Turning Point Lending is a game-changer."

Laura CDes Moines, IA

"I am extremely satisfied with Turning Point Lending. Their team is responsive, professional, and truly understands the needs of real estate investors in Kansas."

Steven JTopeka, KS

"Turning Point Lending's flexible loan options and quick funding were exactly what I needed for my Kentucky rehab project. Highly recommend!"

Megan HLouisville, KY

"Their exceptional service and fast turnaround times made my fix and flip project in Louisiana a success. Turning Point Lending is my go-to lender."

Daniel MNew Orleans, LA

"I was impressed by Turning Point Lending's professionalism and efficiency for my Maine project. They provided the funds I needed quickly and without hassle."

Olivia PPortland, ME

"Turning Point Lending's team is knowledgeable, responsive, and a pleasure to work with. They made my Maryland project a smooth experience."

Patrick EAnnapolis, MD

"I highly recommend Turning Point Lending for their excellent service and quick funding in Massachusetts. They truly understand the needs of real estate investors."

Katherine BBoston, MA

"Turning Point Lending's quick and efficient process allowed me to complete my Michigan project on time and within budget. Their team is outstanding."

Robert TDetroit, MI

"Their professionalism and expertise made the lending process easy and stress-free for my Minnesota fix and flip. Turning Point Lending is a fantastic partner for real estate investors."

Christina AMinneapolis, MN

"Turning Point Lending's team provided exceptional service and quick funding for my rehab project in Mississippi. They are a reliable and trustworthy lender."

Joshua DJackson, MS

"I am extremely satisfied with Turning Point Lending's service for my Missouri project. Their quick funding and flexible loan options were exactly what I needed."

Sarah LSt. Louis, MO

"Turning Point Lending made the entire process seamless and efficient for my Montana fix and flip. Their team's expertise and quick funding were invaluable."

Andrew CHelena, MT

"I couldn't be happier with the service I received from Turning Point Lending for my Nebraska project. Their quick turnaround times and professional approach were impressive."

Megan GOmaha, NE

"Turning Point Lending's team is knowledgeable, responsive, and efficient. They made my fix and flip project in New Hampshire a success."

Michael SConcord, NH

"Their quick funding and exceptional service made my rehab project in New Jersey a breeze. Turning Point Lending is a reliable and trustworthy lender."

Emily JNewark, NJ

"Turning Point Lending's expertise and quick turnaround times were crucial to the success of my project in New Mexico. Highly recommend!"

Brian KSanta Fe, NM

"I am extremely satisfied with Turning Point Lending's service for my New York project. Their professional approach and quick funding were exactly what I needed."

Jessica HNew York CIty , NY

"Turning Point Lending's team provided exceptional service and quick funding for my fix and flip project in North Carolina. They are a fantastic partner."

David PCharlotte, NC

"Their quick and efficient loan process helped me stay on track with my project timeline in Ohio. Turning Point Lending is a game-changer."

Amanda RColumbus, OH

"Turning Point Lending's flexible loan options and quick funding were exactly what I needed for my rehab project in Oklahoma. Highly recommend!"

Richard BOklahoma City, OK

"Their exceptional service and fast turnaround times made my fix and flip project in Oregon a success. Turning Point Lending is my go-to lender."

Olivia MPortland, OR

I was impressed by Turning Point Lending's professionalism and efficiency for my Pennsylvania project. They provided the funds I needed quickly and without hassle."

Steven FPhiladelphia, PA

"Turning Point Lending's team is knowledgeable, responsive, and a pleasure to work with. They made my project in Rhode Island a smooth experience."

Katherine DProvidence, RI

"I highly recommend Turning Point Lending for their excellent service and quick funding in South Carolina. They truly understand the needs of real estate investors."

Robert MColumbia, SC

"Turning Point Lending's quick and efficient process allowed me to complete my Tennessee project on time and within budget. Their team is outstanding."

Christina PNashville, TN

"Their professionalism and expertise made the lending process easy and stress-free for my Texas fix and flip. Turning Point Lending is a fantastic partner for real estate investors."

Joshua KDallas, TX

"Turning Point Lending's team provided exceptional service and quick funding for my rehab project in Utah. They are a reliable and trustworthy lender."

Sarah WSalt Lake City, UT

I am extremely satisfied with Turning Point Lending's service for my Virginia project. Their quick funding and flexible loan options were exactly what I needed."

Andrew SRichmond, VA

"Turning Point Lending made the entire process seamless and efficient for my Washington fix and flip. Their team's expertise and quick funding were invaluable."

Megan LOlympia, WA

"I couldn't be happier with the service I received from Turning Point Lending for my West Virginia project. Their quick turnaround times and professional approach were impressive."

Michael DCharleston, WV

"Turning Point Lending's team is knowledgeable, responsive, and efficient. They made my fix and flip project in Wisconsin a success."

Emily NMadison , WI

"Their quick funding and exceptional service made my rehab project in Wyoming a breeze. Turning Point Lending is a reliable and trustworthy lender."

Brian TCheyenne, WY

From start to finish, we understand fix-and-flip deals of all kinds—and we know how to close them successfully.

At Turning Point Lending, we understand that timing is crucial in the dynamic real estate market. That's why our Fix and Flip Loans are designed for quick approvals, ensuring you can seize opportunities when they arise. With competitive rates and flexible terms, you can navigate the world of fix and flip real estate with confidence.

Fix & Flip Program Highlights

Loan Amount: $75,000 - $3,000,000

Eligible Properties: 1-4 Units

Max LTC: 90%

MAX Loan to ARV: 75%

Loan Term: 6, 9, & 12 Month

UP TO

90%

Loan to Cost (LTC)

for Your FixNFlip Project

Our streamlined process and competitive rates ensure that you receive the necessary funds exactly when you need them.

Transform your real estate aspirations into reality with Turning Point Lending's Bridge Loans. When the time comes to seize golden opportunities, our flexible and expeditious financing options can be your bridge between properties. Whether you're looking to upgrade, renovate, or invest in new properties, our dedicated support has you covered every step of the way.

Bridge Program Highlights

Loan Amount: $75,000 - $3,000,000

Eligible Properties: 1-4 Units

Max LTC: N/A

MAX Loan to ARV: 75%

Loan Term: 6, 9, & 12 Month

UP TO

90%

Loan to Cost (LTC)

for Your FixNFlip Project

With Turning Point Lending by your side, you'll have access to flexible terms and competitive rates that create a solid financial foundation for your construction project.

Embark on a transformative journey in the world of real estate development with Turning Point Lending's New Construction Loans. These specialized financing options are the stepping stones to turning vacant or rundown lots into magnificent properties. Our comprehensive financing covers everything from land acquisition and construction costs to permits and beyond.

New Construction Program Highlights

Loan Amount: $75,000 - $3,000,000

Up to 100% of construction budget

Up to 24-month term available

1-4 Single-Family Homes, Condos, Townhomes

LLCs, LPs, and Corporations

UP TO

85%

Loan to Cost (LTC) for Your New Construction Projec

Our commitment to your financial well-being is unwavering, reflected in our competitive interest rates and flexible terms

Experience the remarkable potential of Turning Point Lending's Debt Service Coverage Ratio (DSCR) Loans for your commercial real estate endeavors. DSCR loans are designed with your long-term success in mind, considering the property's cash flow potential to ensure your investment remains sustainable and profitable.

Rental DSCR Program Highlights

Loan Amount: $100,000 to $2,000,000

Eligible Properties: 1-4 Units

Max LTC: 80% Purchase and Term Refiance 75% Cashout Refiance

Seasoning Period: 90 Days

Loan Term Options:

30-Year Fixed

30-Year Fixed Interest Only

10/1 ARM

5/1 ARM

UP TO

90%

Loan to Cost (LTC)

Our Service Area

Testimonials

"Turning Point Lending provided excellent service and quick funding for my fix and flip project in Alabama. They understood my needs and delivered beyond expectations."

John DMontgomery, AL

"In Arizona, I was impressed by the professionalism and speed at which Turning Point Lending operates. They made my rehab project seamless."

Lisa MPhoenix, AZ

"As a first-time real estate investor in Arkansas, I appreciated the guidance and support from Turning Point Lending. Their expertise made all the difference."

Mark RLittle Rock, AR

"Turning Point Lending's team is incredibly knowledgeable and efficient. They helped me secure funding quickly for my California renovation project."

Sarah TSacramento, CA

"Their loan process in Colorado is straightforward and hassle-free. Turning Point Lending provided the funds I needed to complete my fix and flip in record time."

David HDenver, CO

"I highly recommend Turning Point Lending for their exceptional customer service and quick turnaround times in Connecticut. They are a true partner in real estate investment."

Emily GHartford, CT

"Turning Point Lending exceeded my expectations with their flexible loan options and prompt funding for my Delaware project. My project was a success thanks to their support."

Michael BDover, DE

"The team at Turning Point Lending is professional, responsive, and knowledgeable. They made the lending process smooth and efficient for my Florida fix and flip."

Jessica STampa, FL

"I am thrilled with the service I received from Turning Point Lending for my Georgia rehab. Their quick funding and competitive rates are unmatched."

Brian LAtlanta, GA

"Turning Point Lending's expertise in hard money loans made my fix and flip project in Hawaii a breeze. Their team is top-notch."

Rebecca PHonolulu, HI

"From start to finish, Turning Point Lending provided exceptional service. Their quick funding allowed me to complete my Idaho project ahead of schedule."

James KBoise, ID

"I couldn't have asked for a better lending partner for my Illinois project. Turning Point Lending's professional approach and quick disbursals were crucial to my success."

Amanda FChicago, IL

Turning Point Lending made the entire process easy and stress-free for my Indiana fix and flip. Their team's knowledge and support were invaluable."

Richard WIndianapolis, IN

"Their quick and efficient loan process helped me stay on track with my project timeline in Iowa. Turning Point Lending is a game-changer."

Laura CDes Moines, IA

"I am extremely satisfied with Turning Point Lending. Their team is responsive, professional, and truly understands the needs of real estate investors in Kansas."

Steven JTopeka, KS

"Turning Point Lending's flexible loan options and quick funding were exactly what I needed for my Kentucky rehab project. Highly recommend!"

Megan HLouisville, KY

"Their exceptional service and fast turnaround times made my fix and flip project in Louisiana a success. Turning Point Lending is my go-to lender."

Daniel MNew Orleans, LA

"I was impressed by Turning Point Lending's professionalism and efficiency for my Maine project. They provided the funds I needed quickly and without hassle."

Olivia PPortland, ME

"Turning Point Lending's team is knowledgeable, responsive, and a pleasure to work with. They made my Maryland project a smooth experience."

Patrick EAnnapolis, MD

"I highly recommend Turning Point Lending for their excellent service and quick funding in Massachusetts. They truly understand the needs of real estate investors."

Katherine BBoston, MA

"Turning Point Lending's quick and efficient process allowed me to complete my Michigan project on time and within budget. Their team is outstanding."

Robert TDetroit, MI

"Their professionalism and expertise made the lending process easy and stress-free for my Minnesota fix and flip. Turning Point Lending is a fantastic partner for real estate investors."

Christina AMinneapolis, MN

"Turning Point Lending's team provided exceptional service and quick funding for my rehab project in Mississippi. They are a reliable and trustworthy lender."

Joshua DJackson, MS

"I am extremely satisfied with Turning Point Lending's service for my Missouri project. Their quick funding and flexible loan options were exactly what I needed."

Sarah LSt. Louis, MO

"Turning Point Lending made the entire process seamless and efficient for my Montana fix and flip. Their team's expertise and quick funding were invaluable."

Andrew CHelena, MT

"I couldn't be happier with the service I received from Turning Point Lending for my Nebraska project. Their quick turnaround times and professional approach were impressive."

Megan GOmaha, NE

"Turning Point Lending's team is knowledgeable, responsive, and efficient. They made my fix and flip project in New Hampshire a success."

Michael SConcord, NH

"Their quick funding and exceptional service made my rehab project in New Jersey a breeze. Turning Point Lending is a reliable and trustworthy lender."

Emily JNewark, NJ

"Turning Point Lending's expertise and quick turnaround times were crucial to the success of my project in New Mexico. Highly recommend!"

Brian KSanta Fe, NM

"I am extremely satisfied with Turning Point Lending's service for my New York project. Their professional approach and quick funding were exactly what I needed."

Jessica HNew York CIty , NY

"Turning Point Lending's team provided exceptional service and quick funding for my fix and flip project in North Carolina. They are a fantastic partner."

David PCharlotte, NC

"Their quick and efficient loan process helped me stay on track with my project timeline in Ohio. Turning Point Lending is a game-changer."

Amanda RColumbus, OH

"Turning Point Lending's flexible loan options and quick funding were exactly what I needed for my rehab project in Oklahoma. Highly recommend!"

Richard BOklahoma City, OK

"Their exceptional service and fast turnaround times made my fix and flip project in Oregon a success. Turning Point Lending is my go-to lender."

Olivia MPortland, OR

I was impressed by Turning Point Lending's professionalism and efficiency for my Pennsylvania project. They provided the funds I needed quickly and without hassle."

Steven FPhiladelphia, PA

"Turning Point Lending's team is knowledgeable, responsive, and a pleasure to work with. They made my project in Rhode Island a smooth experience."

Katherine DProvidence, RI

"I highly recommend Turning Point Lending for their excellent service and quick funding in South Carolina. They truly understand the needs of real estate investors."

Robert MColumbia, SC

"Turning Point Lending's quick and efficient process allowed me to complete my Tennessee project on time and within budget. Their team is outstanding."

Christina PNashville, TN

"Their professionalism and expertise made the lending process easy and stress-free for my Texas fix and flip. Turning Point Lending is a fantastic partner for real estate investors."

Joshua KDallas, TX

"Turning Point Lending's team provided exceptional service and quick funding for my rehab project in Utah. They are a reliable and trustworthy lender."

Sarah WSalt Lake City, UT

I am extremely satisfied with Turning Point Lending's service for my Virginia project. Their quick funding and flexible loan options were exactly what I needed."

Andrew SRichmond, VA

"Turning Point Lending made the entire process seamless and efficient for my Washington fix and flip. Their team's expertise and quick funding were invaluable."

Megan LOlympia, WA

"I couldn't be happier with the service I received from Turning Point Lending for my West Virginia project. Their quick turnaround times and professional approach were impressive."

Michael DCharleston, WV

"Turning Point Lending's team is knowledgeable, responsive, and efficient. They made my fix and flip project in Wisconsin a success."

Emily NMadison , WI

"Their quick funding and exceptional service made my rehab project in Wyoming a breeze. Turning Point Lending is a reliable and trustworthy lender."

Brian TCheyenne, WY