New Construction

Streamlined Financing for Ground-Up Projects.

Building from the ground up requires precision and the right financial partner to bring your vision to life. At Turning Point Lending, we offer flexible funding solutions designed to support your timelines and help your projects succeed.

Competitive Rates

Boost your profits with our competitive rates and tailored New Construction loan terms.

High Leverage

Keep your capital intact with financing of up to 85% LTC on our New Construction Loans.

Flexibility & Support

Diverse loan options and expert support help maximize your ROI and streamline the process.

Empowering Your Vision, One Build at a Time.

Our New Construction Loans are crafted to provide the flexibility, competitive terms, and fast approvals you need to bring your vision to life. Whether your goal is to build a single-family home or a multi-unit property, we’re here to ensure your project stays on track from start to finish.

New Construction Program Highlights

Loan Amount: $150,000 - $3,000,000

Finance up to 85% LTC, 70% LTARV

Up to 100% of construction budget

Fast draw process, disburse funds 2-4 days

Up to 24-month term available

1-4 Single-Family Homes, Condos, Townhomes

LLCs, LPs, and Corporations

Building Your Success from the Ground Up

At Turning Point Lending, we specialize in new construction financing for vertical construction on shovel ready, fully entitled infill lots. Whether you are building to sell or hold as a rental, our loans provide the capital and flexibility needed to bring your project to life. We finance single builds and small to medium sized residential developments, offering tailored solutions for experienced builders and developers.

We understand that timing is everything in real estate development, which is why our fast approvals and flexible loan structures ensure you get the funding you need when you need it. Our financing covers ground-up residential projects, offering solutions such as construction draws, partial takeouts, and a commonsense underwriting approach to eliminate unnecessary delays.

As real estate investors ourselves, we know the challenges that come with ground-up construction. That is why we go beyond just providing loans. We act as a strategic financing partner, helping you scale your business, maximize profitability, and build with confidence.

Fast, Reliable Draw Process to Keep Your Project Moving

We know that quick access to funds is essential for keeping your new construction project on schedule. Whether you are building a single-family home or a residential development, delays in financing can slow progress and impact profitability.

That’s why we have streamlined our construction draw process to ensure you receive funds quickly and efficiently, typically within 2 to 4 business days. Our process is designed for speed and simplicity, so you can focus on building, not waiting for financing. With fast inspections and reliable disbursements, we help you maintain momentum and keep your project on track from foundation to final finishes.

New Construction Ground Up FAQ

Financing a new construction project comes with many moving parts, and having the right lending partner can make all the difference. At Turning Point Lending, we work with builders and developers to provide fast, flexible funding that keeps projects moving from foundation to final finishes.

Whether you are working on a single-family home or a small to medium sized residential development, securing reliable financing is key to maintaining cash flow, covering material and labor costs, and staying on schedule. Our new construction loans are structured to meet the unique needs of ground up builders, offering quick approvals, flexible loan terms, and a streamlined draw process.

Have questions about how our new construction loans work? Below, we answer some of the most common questions builders and investors ask about financing their projects.

What Are New Construction Loans and How Do They Work?

A new construction loan is a short-term financing solution designed for ground up residential projects, providing builders and developers with the capital needed to cover land acquisition, material costs, labor, and construction expenses. Unlike traditional mortgages, these loans are disbursed through a draw process, ensuring funds are available at key stages of construction rather than in a lump sum.

Most private lenders offer flexible loan structures based on project viability, borrower experience, and market conditions, rather than relying solely on credit scores. While some lenders finance a wide range of developments, others focus on specific project types.

At Turning Point Lending, we specialize in vertical construction financing for shovel ready, fully entitled residential projects, including single family homes and small to medium sized developments. Our loans offer fast approvals, flexible loan terms, and a streamlined draw process so you can keep your project on schedule and maximize profitability.

What Are the Requirements for a New Construction Loan?

The requirements for a new construction loan vary by lender, but private lenders typically focus on the project’s viability, borrower experience, and financial structure rather than just credit scores. Here are the most common criteria:

- Property Type – Most private lenders require the project to be a shovel ready, fully entitled residential development, such as a single-family home or a small to medium sized residential project.

- Down Payment & Loan-to-Cost (LTC) – Many lenders finance up to 85% of total project costs, including land acquisition, materials, and construction expenses.

- Credit Score – While banks impose strict credit requirements, private lenders typically prioritize the project’s profitability over the borrower’s credit score. A 650+ score is often preferred, but exceptions may be made.

- Experience Level – Having prior new construction experience is beneficial, but first-time builders may still qualify with strong financials and a well-structured project plan.

- Exit Strategy – Borrowers should have a clear plan to sell or refinance the property upon completion.

- Reserves & Liquidity – Many lenders require cash reserves to cover loan payments, closing costs, and potential project overruns.

What Are the Costs of a New Construction Loan?

The cost of a new construction loan depends on several factors, including the loan amount, interest rate, loan term, and lender fees. Unlike traditional mortgages, new construction loans are short-term, asset-based loans designed to provide the capital you need to complete your project efficiently. Here’s a breakdown of typical costs:

- Interest Rates – Usually range from 10% to 13%, depending on the loan structure and borrower experience.

- Points (Origination Fees) – Typically 1 to 3 points (1% to 3% of the loan amount).

- Loan Term – Most new construction loans are 6 to 18 months, giving builders time to complete the project without excessive long-term interest costs.

- Down Payment & Loan-to-Cost (LTC) – Lenders typically finance up to 85% of total project costs, covering land acquisition, materials, and labor.

- Other Fees – May include processing fees, appraisal fees, and closing costs.

We structure our new construction loans to keep costs competitive while ensuring you have the capital and flexibility needed to complete your project successfully. Our fast approvals, streamlined draw process, and investor-friendly terms help you focus on building and not worrying about financing.

How Fast Can I Get Approved and Funded for a New Construction Loan?

Speed is essential when it comes to new construction financing, and delays in funding can slow down your project and increase costs. While traditional banks may take months to approve and fund a construction loan, private lenders offer a much faster process.

At Turning Point Lending, we prioritize speed and efficiency to keep your project on track:

- Preliminary Approvals – Borrowers can receive pre-approval within 24 to 48 hours after submitting a loan application.

- Loan Closings – Once approved, we work quickly to close loans in as little as 14 days, depending on project complexity.

- Construction Draws – Borrowers can request funds as needed throughout the project, with draws typically funded within 2 to 4 business days after inspection approval.

Our streamlined loan process, quick decision-making, and efficient draw process ensure you have capital when you need it, so you can keep building without delays.

Do You Offer Loans for Spec Homes or Pre-Sold Homes?

Yes, at Turning Point Lending, we offer new construction financing for both spec homes and pre-sold homes. Whether you are building on speculation or already have a buyer under contract, we provide fast, flexible loans to help you complete your project with confidence.

- Spec Home Loans – Designed for builders who construct homes without a committed buyer, allowing you to develop and sell the property once completed.

- Pre-Sold Home Loans – Ideal for builders who already have a signed purchase contract with a buyer, providing the necessary funding to complete construction.

Both loan options feature competitive terms, quick approvals, and an efficient draw process, ensuring you receive funds when you need them to keep your project on schedule.

What Are the Common Challenges in New Construction Financing and How Do You Help?

New construction financing comes with unique challenges that can delay projects, increase costs, and create cash flow issues if not managed properly. At Turning Point Lending, we understand these obstacles and offer solutions to help builders and developers stay on track.

- Slow Approvals & Funding Delays – Traditional lenders can take months to approve and fund loans, delaying groundbreaking. Our fast pre-approvals (within 24 to 48 hours) and closings (as little as 14 days) ensure you get funding when you need it.

- Complicated Draw Processes – Many lenders have rigid draw schedules that don’t align with your construction timeline. Our flexible draw process allows you to request funds as needed, with disbursements funded within 2 to 4 business days after inspection approval.

- Rigid Loan Terms – Banks often require excessive down payments or restrictive loan terms. We offer up to 85% loan-to-cost financing with tailored loan structures designed for builders.

- Lack of Industry Expertise – Many lenders don’t understand the fast-moving nature of new construction. As real estate investors ourselves, we structure loans to maximize efficiency and profitability for builders.

Why Choose Turning Point Lending for Your New Construction Loans?

At Turning Point Lending, we understand that new construction projects require speed, flexibility, and reliable funding to stay on schedule and profitable. Unlike traditional banks that have long approval times and rigid requirements, we offer:

- Fast Pre-Approvals & Closings – Get pre-approved within 24 to 48 hours and close in as little as 14 days, so you never miss an opportunity.

- Flexible Loan Structures – We offer financing for shovel ready, fully entitled residential projects, including single family homes and small to medium sized developments.

- Reliable Draw Process – Our efficient construction draw process ensures you receive funds within 2 to 4 business days after inspection approval, keeping your project moving forward.

- Expertise You Can Trust – As real estate investors ourselves, we understand the challenges builders face and work alongside you to structure financing that meets your needs.

With Turning Point Lending, you get more than just a loan. You get a financing partner that helps you scale your business, maximize profitability, and build with confidence.

TestimonialsWhy do our Borrowers love Turning Point Lending?

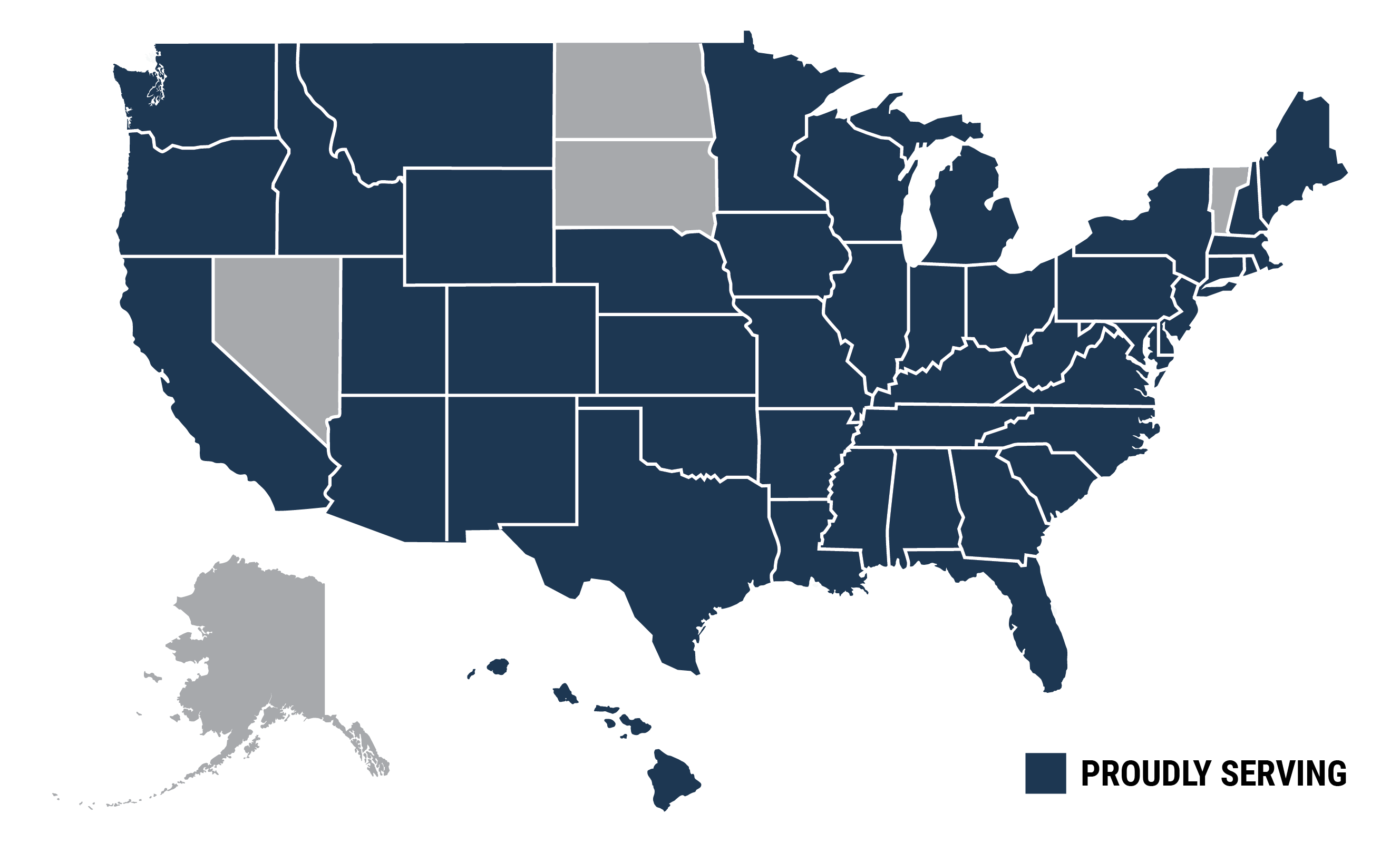

Our Service Area